Consider the odds...

and place your bets accordingly

It’s mid-October 2024 as I write this. The pennant chases are in full swing, and the World Series will be over by November 2nd, which is just a few weeks from today.

If I tell you who will win the World Series, and I establish my credibility as a prognosticator, will you place a $100 bet at your favorite sportsbook?

Assume I’m correct on the World Series, and you make a little money. And then we’ll run the same drill with the Super Bowl in February and then The Masters in April. With each successive (correct) bet, you may want to increase the stakes.

With the advent of technology, it’s exceptionally easy to place a sports bet. It’s all online and at your fingertips, 24/7. No shady bookmakers. Nothing illegal. And you don’t have to make a pilgrimage to Vegas or Atlantic City.

So you can very easily place a few bets, and after you find that my predictions are correct 10 or 20 or 30 times in a row, you might start placing some meaningful wagers and building some wealth. Life-changing wealth? Maybe…that’s up to you.

After 10 or 20 or 30 consecutive wins at the sportsbook, you’ll be wondering whether these events are rigged, and if so, what’s my inside track?

Truthfully, I know nothing about rigged sporting events. But I do know a game that’s rigged, and we all can have an inside track to building wealth. Life-changing wealth? Absolutely.

The game is the planned debasement of the U.S. dollar (USD). And it’s being rigged in plain sight by the biggest, most powerful bosses in history - the Federal government, the Federal Reserve, and the commercial banking system writ large. They don’t need to hide anything from us because (1) it’s all perfectly legal (thanks to Congress), (2) the bosses are guaranteed to win in all scenarios, and (3) most of us pay no attention anyway, which makes the game very easy to play.

Given that framework, what do we know for sure that will enable us to play for profit?

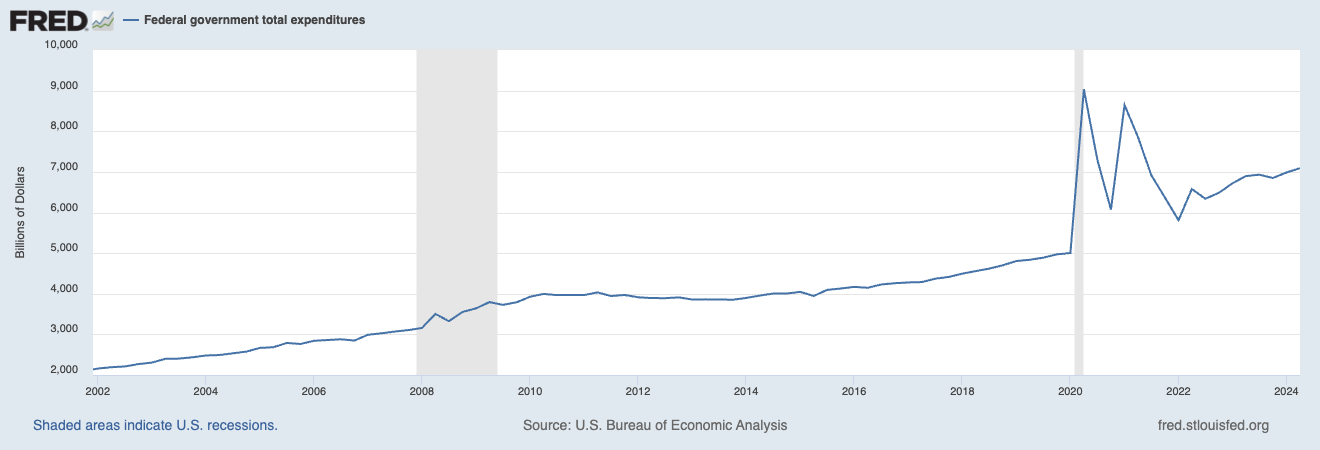

Government spending always grows in nominal $ terms. Year-over-year growth is a very high probability, and growth over longer periods like 3 years or 5 years is absolutely guaranteed.

Government deficits always grow in nominal $ terms. Year-over-year growth is a very high probability, and growth over longer periods like 3 years or 5 years is absolutely guaranteed.

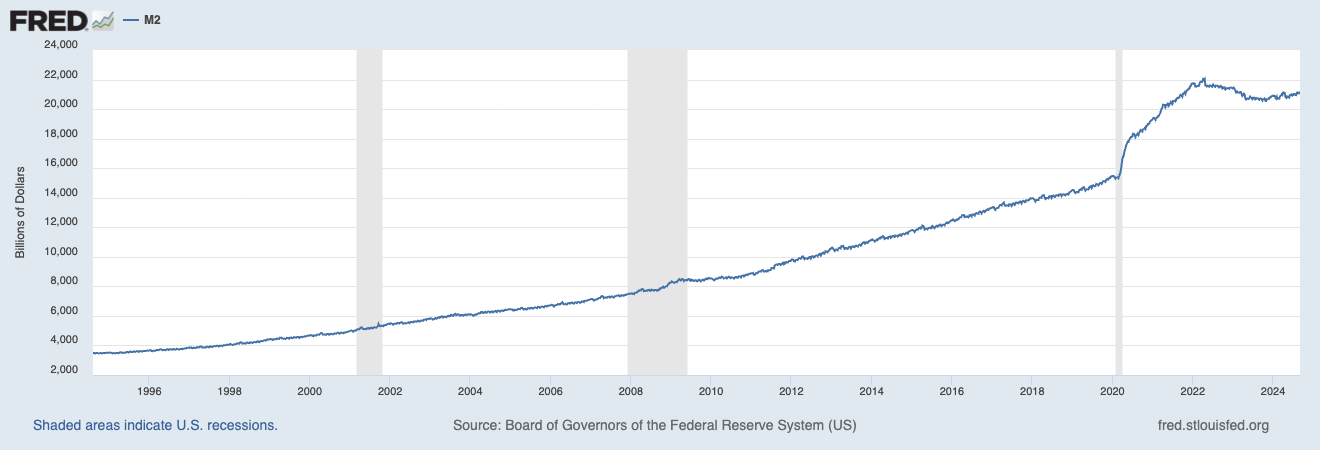

Money supply (USD) always grows in nominal $ terms. Over short periods, growth of the money supply is a high probability event, and over longer periods, it’s a lock.

Inflation is not just the norm; it’s absolutely required. Maybe inflation is low and under control for a time. And at other times, inflation will spike higher and threaten to spiral out of control. But inflation will never go away because the bosses know (and now you know) that our debt-fueled economy would collapse without it.

You shouldn’t take any of this at face value. Check the facts (St. Louis Federal Reserve | FRED is the easiest source) and you’ll begin to understand the credibility of these forecasts. Go back 10 or 20 or 30 years, and you’ll see how consistently these trends hold through time.

Sure, we can debate (or rant) about big government vs. small government, good politicians vs. bad politicians, honest bankers vs. corrupt bankers. But the non-controversial conclusion is that human nature, straight-forward incentives, and good old math will make these forecasts solid as a rock for the next 10 or 20 or 30 years, or more.

So who has the inside track? Anyone with assets can place his or her bets alongside the bosses to win a few bucks or to build wealth. Life-changing wealth? Absolutely.

Here’s the line you want to bet —> buy quality, cash flowing real estate with a 20 to 50 year view. Collect regular distributions from cash flow and keep placing new bets…every month, every quarter, every year. Compound your bets as long as you can. Cash in your chips when necessary, but be sure to do it in a tax-wise way (more on this later).

I mentioned earlier that sports betting used to be hard or at least a little shady, but now it’s incredibly easy with the advent of technology. In the same way, commercial real estate investing used to be only for the select few, but now with the emergence of blockchain technology, it’s readily accessible for all investors.

In the old days (all of three years ago!), there were high barriers to entry for any real estate investment, and commercial real estate investment was particularly difficult. Most investors only had a few relevant choices:

Buy your own home, but be ready to commit a substantial down payment that could take years to accumulate, or

Scrape together millions of dollars or corral lots of partners and go find good assets for direct investment and direct management, or

Have the right connections to get invited into private equity deals or hedge funds or quality real estate syndications.

Now, with the advent of blockchain technology, commercial real estate investing will be available for everyone and with minimum investment thresholds in the $100s of dollars, not $100,000 or more. To be clear, I’m not talking about cryptocurrency.* I’m referring to investments in real world assets, wherein your share of the asset is transacted, tracked, and immutably stored on the blockchain and represented by a security token. Functionally, it’s not far off from owning shares in a public company and holding those shares in your Schwab account, but it’s incredibly efficient at a small scale and therefore perfect for diversified real estate investing.

Investing in commercial real estate via blockchain technology will be as easy as placing a $100 bet on the World Series. But rest assured, the outcome will be far more certain, because the bosses have rigged the odds in your favor.

Join the club of those who are paying attention to the rigged game of USD debasement and accumulating assets with the inside track to long term success. The patient compounding and spreading of our bets present the opportunity to build life-changing wealth. Investing on the blockchain now makes this possible in ways never imagined even five years ago, and it opens up a world of opportunity in commercial real estate investing.

There’s a lot more to discuss here, so if I’ve piqued your interest, stick with me on this substack and / or join me on my website to learn more about the details of leveraging blockchain real estate investing to profit from our bets.

*Note: We’ll work through the distinction between blockchain investing and cryptocurrency investing in another post.